When it comes to trading in the forex market, one of the most popular currency pairs is EUR/USD. This currency pair is the most actively traded and is often one of the most volatile. For this reason, traders often look for the best strategy to trade EUR/USD in the forex market.

Before diving into the best strategy to trade EUR/USD in the forex market, let’s take a look at some of the basic concepts necessary to understand how this currency pair works and how to trade it.

The Basics of EUR/USD

EUR/USD stands for the euro and the US dollar. This currency pair reflects the relative value between the euro and the US dollar. When trading EUR/USD, you are essentially speculating on the relative value between the two currencies.

What Moves EUR/USD?

When trading EUR/USD, it is important to understand what moves the currency pair. The most important factors that affect the value of EUR/USD are:

Interest rate differential: The interest rate differential between the European Central Bank (ECB) and the Federal Reserve (Fed) is a major factor that influences the EUR/USD exchange rate.

Economic data: Economic data from both the Eurozone and the US is also a major factor that influences the EUR/USD exchange rate. Important economic data releases such as GDP, employment, and inflation figures can all have a significant impact on the EUR/USD exchange rate.

Politics: Political developments in both the US and the Eurozone can also have an effect on the EUR/USD exchange rate. This includes both domestic and international political developments.

Sentiment: Lastly, sentiment is another major factor that can influence the EUR/USD exchange rate. This includes both investor sentiment as well as market sentiment.

Best Strategy to Trade EUR/USD

Now that you know the basic factors that influence the EUR/USD exchange rate, let’s take a look at some of the best strategies to trade EUR/USD in the forex market.

Fundamental Analysis: Fundamental analysis involves analyzing the economic and political factors that influence the EUR/USD exchange rate.

Fundamental traders look for various economic data releases and political developments that can impact the EUR/USD exchange rate.

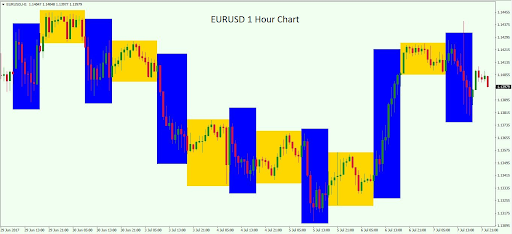

Technical Analysis: Technical analysis is a form of analysis that relies on analyzing the past price action of the currency pair. Technical traders look for trends, support and resistance levels, chart patterns, and other technical indicators to try to gain an edge in their trades.

Sentiment Analysis: Sentiment analysis involves gauging investor sentiment and market sentiment in order to try to predict future price movements of the currency pair.

Momentum Trading: Momentum trading involves trying to ride trends by entering the market at key points. Momentum traders look to enter the market when the currency pair is trending in a particular direction and then exit the market when the trend starts to reverse.

Range Trading: Range trading involves trading in a range-bound market. In a range-bound market, the currency pair moves between two levels and traders look to take advantage of these levels by buying at the lower end of the range and selling at the upper end.

Scalping: Scalping involves taking advantage of short-term opportunities in the market by opening and closing positions quickly..

While there are many different strategies and approaches to trading EUR/USD in the forex market, the best strategy to use will depend on your trading style, risk tolerance, and overall trading goals.