Liquid and illiquid Forex pairs are two types of currency pairs that are traded on the foreign exchange market. The foreign exchange market, or Forex, is one of the largest and most liquid financial markets in the world, with a daily trading volume of over $5 trillion.

As such, there are a wide variety of currency pairs available to traders. While some of these pairs are highly liquid, meaning they are actively traded and have a large number of buyers and sellers, others are much less liquid and may be difficult to trade.

Understanding the difference between liquid and illiquid Forex pairs can help traders make more informed decisions when trading in the Forex market.

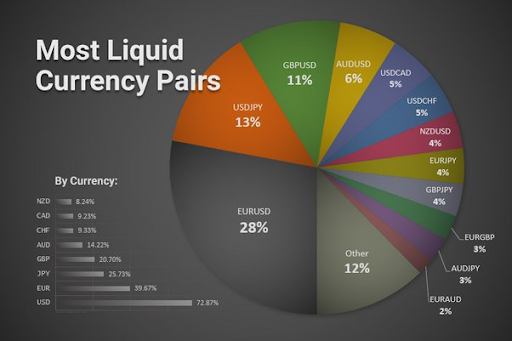

Liquid Forex pairs are those that are traded more frequently and have more buyers and sellers than illiquid pairs. They tend to be the most popular, most traded, and most liquid currencies in the Forex market.

Major currency pairs such as the EUR/USD, USD/JPY, GBP/USD, and USD/CHF are all examples of liquid Forex pairs. These pairs usually provide traders with more liquidity, tighter spreads, and better execution.

In contrast, illiquid Forex pairs are those that are not as frequently traded and have fewer buyers and sellers. These pairs are generally less popular than their liquid counterparts and tend to have less liquidity. Examples of illiquid Forex pairs include the USD/CAD, AUD/JPY, NZD/CAD, and EUR/NOK. These pairs tend to have wider spreads and less liquidity than the more actively traded pairs.

Understanding the difference between liquid and illiquid Forex pairs can help traders make more informed decisions when trading in the Forex market. For example, illiquid Forex pairs may offer traders with less liquidity the chance to enter and exit positions more easily.

On the other hand, more liquid pairs may require traders to execute more trades in order to obtain the desired result. As such, it is important for traders to understand the difference between liquid and illiquid Forex pairs and to trade accordingly.

When trading in the Forex market, it is important to take into account the liquidity of the currency pair. As a general rule, traders should avoid trading in illiquid Forex pairs, as these pairs tend to have wider spreads, less liquidity, and more risk.

On the other hand, traders should also be aware that liquid Forex pairs may require more trades to obtain the desired result. As such, traders should consider the liquidity of the pair before entering into a position.

Overall, liquid and illiquid Forex pairs are two types of currency pairs that are traded on the foreign exchange market. Major currency pairs such as the EUR/USD, USD/JPY, GBP/USD, and USD/CHF are all examples of liquid Forex pairs and tend to provide traders with more liquidity, tighter spreads, and better execution.

On the other hand, illiquid Forex pairs such as the USD/CAD, AUD/JPY, NZD/CAD, and EUR/NOK tend to have wider spreads and less liquidity than the more actively traded pairs.

As such, it is important for traders to understand the difference between liquid and illiquid Forex pairs and to trade accordingly.

Disclaimer: Our content is intended to be used for informational purposes only. It is very important to do your own research before making any investment based on your own personal circumstances. You should take independent financial advice from a professional in connection with, or independently research and verify, any information that you find on this article and wish to rely upon, whether for the purpose of making an investment decision or otherwise. We do not provide any warranties regarding the information in this website and are not responsible for any losses or damages incurred as a result of trading or investing.